Pacific Prime Can Be Fun For Everyone

Table of ContentsSee This Report about Pacific PrimeUnknown Facts About Pacific PrimePacific Prime for DummiesLittle Known Facts About Pacific Prime.Some Known Incorrect Statements About Pacific Prime

Your agent is an insurance policy specialist with the knowledge to assist you with the insurance policy procedure and aid you find the most effective insurance coverage protection for you and the people and points you appreciate a lot of. This post is for educational and suggestion purposes only. If the plan insurance coverage summaries in this short article dispute with the language in the policy, the language in the policy uses.

Policyholder's deaths can also be backups, especially when they are taken into consideration to be a wrongful fatality, along with residential or commercial property damage and/or destruction. Because of the uncertainty of stated losses, they are identified as backups. The guaranteed individual or life pays a premium in order to obtain the advantages guaranteed by the insurance firm.

Your home insurance can assist you cover the damages to your home and afford the expense of rebuilding or repair work. Occasionally, you can also have coverage for things or prized possessions in your home, which you can after that buy substitutes for with the cash the insurance provider provides you. In case of an unfortunate or wrongful fatality of a sole earner, a family's monetary loss can potentially be covered by particular insurance strategies.

The 2-Minute Rule for Pacific Prime

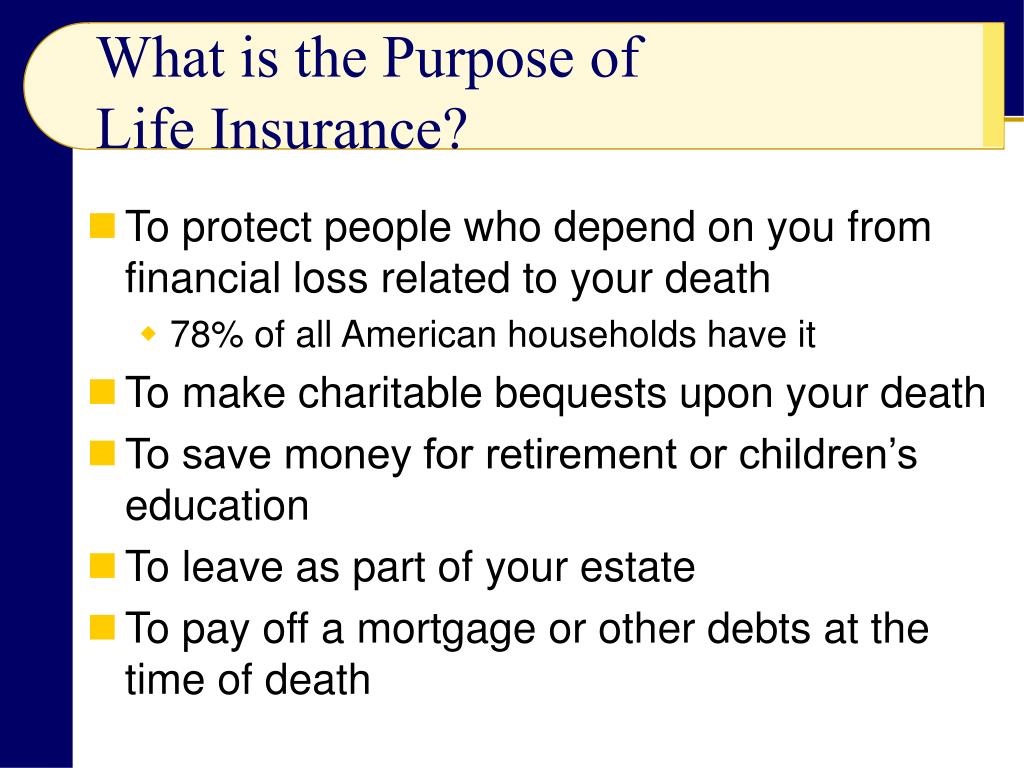

There are different insurance policy plans that include cost savings and/or investment systems in enhancement to regular protection. These can assist with structure financial savings and wealth for future generations by means of regular or repeating financial investments. Insurance can assist your family members maintain their standard of life in the event that you are not there in the future.

One of the most standard form for this type of insurance policy, life insurance, is term insurance. Life insurance coverage as a whole assists your household come to be safe monetarily with a payout quantity that is given up the occasion of your, or the plan owner's, death during a details plan duration. Kid Strategies This sort of insurance coverage is basically a financial savings tool that aids with creating funds when children get to certain ages for seeking college.

Home Insurance This sort of insurance policy covers home damages in the incidents of mishaps, all-natural tragedies, and accidents, together with other comparable events. maternity insurance for expats. If you are looking to look for payment for accidents that have actually occurred and you are battling to figure out the proper course for you, connect to us at Duffy & Duffy Law Practice

Some Known Details About Pacific Prime

At our law practice, we comprehend click here to read that you are experiencing a lot, and we comprehend that if you are concerning us that you have actually been through a whole lot. https://www.openstreetmap.org/user/pacificpr1me. Due to that, we provide you a free consultation to discuss your issues and see how we can best help you

Since of the COVID pandemic, court systems have actually been closed, which adversely affects car crash cases in a tremendous means. Once more, we are right here to assist you! We proudly offer the individuals of Suffolk Region and Nassau Area.

An insurance plan is a legal agreement in between the insurance firm (the insurance provider) and the individual(s), organization, or entity being insured (the insured). Reading your plan aids you validate that the plan meets your requirements and that you recognize your and the insurance provider's duties if a loss occurs. Numerous insureds purchase a policy without understanding what is covered, the exclusions that eliminate protection, and the conditions that must be met in order for coverage to use when a loss happens.

It identifies who is the insured, what threats or residential property are covered, the plan limitations, and the policy period (i.e. time the plan is in force). The Statements Web page of a life insurance policy will consist of the name of the person insured and the face quantity of the life insurance coverage policy (e.g.

This is a summary of the significant promises of the insurance business and mentions what is covered.

Things about Pacific Prime

Allrisk protection, under which all losses are covered except those losses especially left out. If the loss is not omitted, after that it is covered. Life insurance policy policies are generally all-risk policies. Exemptions take protection far from the Insuring Agreement. The 3 major kinds of Exemptions are: Left out hazards or root causes of lossExcluded lossesExcluded propertyTypical instances of left out hazards under a home owners policy are.